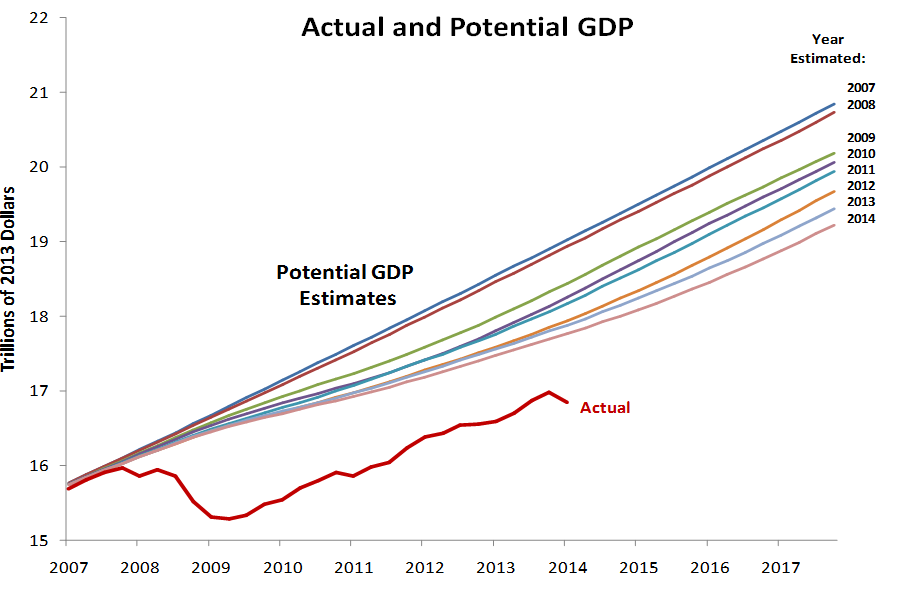

Alvin Hansen proclaimed the risk of secular stagnation at the end of the 1930s only to see the economy boom during and after World War II. It is certainly possible that either some major exogenous event will occur that raises spending or lowers saving in a way that raises the FERIR in the industrial world and renders the concerns I have expressed irrelevant. Short of war, it is not obvious what such events might be. Moreover, most of the reasons adduced for falling FERIRs are likely to continue for at least the next decade. And there is no evidence that potential output forecasts are being increased even in countries like the US where there is some sign of growth acceleration.That's Larry Summers trying to make sense out of the Obama Administration's economy. For which, this picture is worth many thousands of Summers's words;

Which is what happens when the economists in an administration cannot shake loose from the idea that interest rates are the transmission mechanism that matters. As Summers clearly cannot;

I explain why a decline in the full employment real interest rate – FERIR, for short – coupled with low inflation could indefinitely prevent the attainment of full employment.Let us help you, Guy; persistence of abnormally low interest rates alongside persistently anemic economic growth and persistently high unemployment, are the classic signs of an overly tight monetary policy. Which is what you should have been whispering in Barack Obama's ear, when you had the chance. As opposed to the pablum;

Rising inequality operates to raise the share of income going to those with a lower propensity to spend.Wake us when the Obama Administration is over. Please.

Is there any way to tell if monetary policy is loose or tight other than looking back a few years to see how the economy did? Why isn't the supply of donuts subject to wild swings of looseness and tightness?

ReplyDeleteThe holy grail of monetary economists is to find an indicator that unequivocally tells you whether policy is loose, tight, or Goldilocks-like. Which is the attraction--like moths to a flame--of interest rates.

ReplyDeleteUnfortunately, interest rates aren't a reliable indicator. Whether NGDP futures would be so, won't be known until tried.

I suspected that answer, but doubted it could be true. Macro-econs just don't know, but they are willing to guess.

ReplyDeleteWhy the wild enthusiasm to muck around with the economy, a complicated system which they don't understand? Well, at least they can't cause any damage.