... 81 percent of covered workers are in plans with a general annual deductible, which average $1,318 for single coverage this year. Covered workers in smaller firms (three to 199 workers) face an average deductible of $1,836 this year. That’s 66 percent more than the $1,105 average deductible facing covered workers at large firms (at least 200 workers).We note the date;

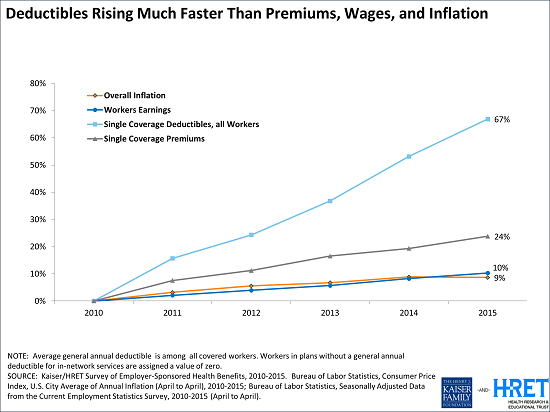

Since 2010, both the share of workers with deductibles and the size of those deductibles have increased sharply. These two trends together result in a 67 percent increase in deductibles since 2010, much faster than the rise in single premiums (24%) and about seven times the rise in workers’ wages (10%) and general inflation (9%).It was in 2010 that a Democrat congress passed Obamacare. So that we could, in Nancy Pelosi's words, find out what was in it. Wonder how many Americans expected this?

“With deductibles rising so much faster than premiums and wages, it’s no surprise that consumers have not felt the slowdown in health spending,” Foundation President and CEO Drew Altman said.

Unfortunately, Kaiser makes an elementary error in this statement of supposed fact;

The average annual premium for single coverage is $6,251, of which workers on average pay $1,071. The average family premium is $17,545, with workers on average contributing $4,955.Workers pay the entire amount. What Kaiser is promoting is false incidence; the employer pays for its share by reducing the amount the workers get in their paychecks as wages and salaries. Substituted for with a health insurance benefit--which, at least, is not taxed by the government as income.

No comments:

Post a Comment