Today, Scott notices a WSJ piece by Jon Hilsenrath and Ben Leubsdorf, repeating the error that interest rates are the price of money.

The conundrum challenges much of what central bankers thought they understood about the world, as well as their ability to do their job. How will they know when to raise or lower interest rates [our bold] if they’re unsure what causes consumer prices to rise and fall?Here, being the annual Jackson Hole, Wyoming conference put on by the KC Fed. From which Scott attempts to break out again;

“There is definitely less confidence, a lot less confidence” about how inflation works, James Bullard, President of the Federal Reserve Bank of St. Louis, said in an interview here Friday.

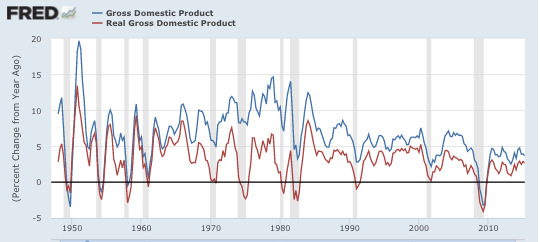

Fortunately, there another nominal variable [NGDP] that still does track the business cycle very closely:

If the WSJ article is any guide, at least some of The Fed's decision makers are still trapped in 1968, when Professor (and former head of the Council of Economic Advisers to the President) Walter Heller made the egregious error of claiming that;

I really don't understand how the scarcity of any commodity can be gauged without referring to its price -- or, more specifically, how the scarcity of money can be gauged without referring to interest rates. .... To insist that the behavior of the price of money (interest rates) conveys no information about its scarcity is, as [Yale economist James] Tobin has noted, an "odd heresy."Milton Friedman pounced on that error;

The interest rate is not the price of money.... The price of money is how much goods and services you have to give up to get a dollar. You can get big changes in the quantity of money without any changes in credit.If economists want to stop confusing themselves, they need to stop thinking of monetary policy in terms of raising and lowering an interest rate (such as the Fed Funds rate at which banks lend overnight to each other).

.... You must sharply distinguish between money in the sense of the money or credit market, and money in the sense of the quantity of money. And the price of money in that second sense is the inverse of the price level--not the interest rate. The interest rate is the price of credit.

No comments:

Post a Comment